Sales is kind of like cooking: the right ingredients, included at the right time, can make all the difference. And just like a chef needs to know their ingredients, sales professionals need to know the key terms and concepts that drive success in their industry.

That's where our go-to sales glossary comes in. This comprehensive list includes 52 must-know terms that will help you navigate the world of sales with confidence and expertise.

From the terms you’ll need to master your key performance indicators (KPIs) to the phrases that will help you close deals, this glossary has you covered. Save this page and keep it close at hand so you’re never at a loss for words (or knowledge) when it comes to sales.

Account-Based Selling (ABS)

Account-based sales is about focusing on individual accounts as opposed to chasing every lead. It’s about prioritizing and tailoring efforts to high-value accounts.

ABS depends on identifying key businesses and the decision-makers in them. This helps sales teams craft custom strategies that resonate with (and convert) prospects.

This hyper-focused method ensures every interaction, campaign, and sales pitch is tailored to an account. This increases conversions and reduces acquisition costs. This makes a big difference, especially in small markets with limited leads.

Account Executive (AE)

An account executive (AE) takes new leads from a sales development representative (SDR) and nurtures them. The idea is to take someone who’s new to your offer and move them along the funnel towards a closed deal.

An AE’s skillset includes communication, organization, negotiation, and leadership. They are also naturally motivated and driven.

Account Management (AM)

Account management (AM) refers to managing client relationships. The goal is to ensure customer satisfaction, help drive customer results, and foster long-term business growth.

Here are a few contexts in which "account management" is commonly used.

- Software: For SaaS companies, account management focuses on driving client results and satisfaction. This can cover addressing any issues, advising on best practices, and responding to questions.

- Agencies: Agency account managers connect clients and the agency's internal team. They make sure that campaigns and projects perform well and drive results. They maintain and build the relationship, understand the client's business deeply, and tap into opportunities.

- B2B sales: In a B2B context, account managers maintain and expand relationships with existing customers. They ensure that the services or products are delivered as promised. They also upsell, cross-sell, and renew contracts.

Average Order Value (AOV)

Average Order Value (AOV) is the average sum customers spend when they make a purchase. To calculate it, divide your total revenue by the number of orders you received during the same period.

For example, if your online store generated $55,000 in a week from 250 orders, the AOV would be $220: $55,000/250. All other things being equal, a higher AOV means a higher level of revenue and profit.

Bottom of the Funnel (BOFU)

BOFU, an acronym for "bottom of the funnel," represents the final stage in the sales funnel. Here, potential clients are on the brink of a purchasing decision.

They've come from the initial awareness phase at the top-of-funnel stage and through consideration during the middle of the funnel. They're actively evaluating offers, comparing vendors, and preparing to make a purchase.

In the BOFU stage, salespeople are dealing with leads that have a high chance of converting. The lead has consumed content, engaged in discovery calls, and shown a deeper interest in a solution or product. As such, the stakes are higher. A meticulous approach here determines whether prior nurturing efforts translate into revenue.

Business Development Representative (BDR)

A business development representative (BDR) is responsible for identifying and generating new business opportunities.

A BDR is typically involved in the early stages of the sales process. This includes outreach and lead qualification. The BDR’s goal is to find potential leads before handing them over to another sales team member for deeper engagement and conversion.

Buyer's Journey

The buyer's journey describes the steps a potential customer takes from first becoming aware of a product to making a purchase. It maps out how customers behave at every step in the buying process.

A typical journey is usually segmented into three stages: awareness, consideration, and decision.

Channel Sales

Channel sales is when third parties help drive sales on your behalf. Distributors, retailers, resellers, and agents are all examples of channel sales partners. Instead of engaging with customers directly, you work through these third parties.

Channel sales can help tap into new audiences, regions, and market segments more easily. They can also give you a low-cost way to test new target audiences.

Churn Rate

Churn rate is the number of customers who stop paying for a product within a specific time frame. It’s also often called just “churn.” Churn rate gives us an idea of how quickly a business loses customers or subscribers.

Close Ratio

Close ratio, also known as win rate, is the ratio of deals closed to quotes sent.

Close ratio is used to determine a sales team's effectiveness. It evaluates how many sales-qualified leads (SQLs) end up becoming paying customers. It tells you how good someone is at converting sales opportunities into actual closed deals.

Cost of Goods Sold (COGS)

Cost of goods sold (COGS) refers to the direct production cost of goods sold by a business. This includes both raw materials and direct labor costs.

For digital products, “raw materials” can include finite, spendable resources, such as bandwidth bought from a third party.

COGS does not include indirect expenses like distribution and sales team costs. These are known as operational expenses or overheads — two similar but different terms — and are calculated separately.

Cold Calling

Cold calling is the art of reaching out to prospects when there’s no prior relationship. This is a proactive sales method that’s typically executed over the phone. The idea is to introduce a product or service, qualify a potential client, and initiate the sales process.

Conversion Rate (CVR)

Conversion rate (CVR) is the percentage of people who take a desired action. For example, if 100 people visit a webpage and 10 of them sign up for a newsletter, the conversion rate is 10%.

Conversion rates apply to all sales funnel stages. So if you take 100 sales-qualified leads (SQLs) and convert five, the conversion rate is 5%.

Customer Relationship Management (CRM)

CRM stands for customer relationship management. It's a holistic framework that helps organizations understand and improve client relations. It also refers to customer relationship management software, which helps apply CRM principles.

- As an ideology: CRM is about understanding customers to serve them better. It’s a cross-department function that spans sales, customer success, and other departments. It’s about using data and insights to give customers more value and drive more revenue.

- As software: CRM is about measuring and centralizing customer data. A CRM platform captures every touchpoint, interaction, and nuance of a business-customer relationship. It logs everything from newsletter opens to service tickets to full-fledged purchases.

This means a CRM gives businesses a detailed record of customer interactions. This turns into insights into behaviors, preferences, and trends. These insights can be used to drive sales, improve operations, design new automation, and more.

Cross-Selling

Cross-selling is selling complementary products or services to a converted customer.

For example, let’s say you’re selling customer relationship management software. As a cross-sell, you might sell payroll outsourcing services. These are not exactly an extension of your core product, but still potentially valuable to your audience.

Cross-sell products should align with the current product a customer bought from you. They should also offer additional value.

In a perfect world, cross-selling creates win-win situations. When done right, it creates value for your customer base while also driving revenue. This can increase your own core product’s perceived value and strengthen relationships.

Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) tells us how much it costs to find a lead and turn it into a customer. It factors in all marketing and sales expenses.

If you invest $500 in outreach and secure five customers, your CAC is $100. If you invest $300 and secure 10 customers, your CAC is $30. All other things being equal, the lower your CAC, the better.

Customer Lifetime Value (CLV)

Customer lifetime value (CLV) measures the total net profit that a business earns from the entirety of its relationship with a customer. It's not just a measure of one purchase, but an estimate of all transactions over the duration of a business relationship.

Direct Sales

Direct sales is selling to customers directly. This usually happens in person, over the phone, or via digital channels like email or async video. If a sale is successful, the prospect buys directly from a business; not via an aggregator, third-party vendor, or reseller.

Direct sales can be found in all niches, from retail to SaaS. Using the method, customers are marketed to, sold to, and billed directly.

Discovery Call

A discovery call is your first conversation with a prospect after they indicate interest in your offer. Its focus is on understanding the needs of a potential client and seeing how your product or service can meet those needs.

The discovery call sets the tone for future discussions and helps identify if a client is a good match. Knowing how to handle this call can either build a strong client engagement or cost you a potential sale.

Employee Onboarding

Employee onboarding is the process of integrating employees into an organization. It is often synonymous with familiarizing them with your product and your business.

Employee onboarding aims to equip new members with comprehensive knowledge and skills. It's essential that the onboarding experience is hands-on, immersing newcomers in the organization's culture and ensuring proficiency with the product.

End of Day (EOD)

End of Day (EOD) indicates the closing hours of a business. In most offices, this means 5 p.m. That being said, with flexible work hours being common in many businesses, this can vary.

EOD isn’t just a time; it’s also a deadline, a communication benchmark, and a stress point in the professional world.

Gatekeeper

A gatekeeper controls access to decision-makers within an organization. They could be a receptionist, an administrative assistant, or a manager.

Their role may be formal or informal. If it is formal, they may be your initial point of contact (PoC), and communications may follow standard operating procedures. If it is informal, you will have to identify the gatekeeper and establish communications with them yourself.

A gatekeeper’s role is to filter out unwanted or irrelevant solicitations. This helps make sure that key decision-makers are only approached with valuable opportunities.

Ideal Customer Profile (ICP)

An ideal customer profile (IPC) is a description of a hypothetical individual or company. This hypothetical entity would happily buy your product and benefit from it immensely. Their pain points, needs, and wants are strongly addressed by our offer.

ICP descriptions include demographic data, behavioral tendencies, and additional traits. Ideal customer profiles are related to — but different from — customer avatars. Unlike customer avatars, they tend to be more data-based and grounded in fact.

Inbound Sales

Instead of vying for a customer’s attention, inbound sales focuses on getting customers to come to you.

The approach is tailored to the buyer's needs, actions, and decision-making process. Instead of cold calling or pushing products, inbound sales professionals provide value and address the specific needs of the prospect. This makes the buying journey a more collaborative process.

Lead Nurturing

Lead nurturing is the process of developing a relationship with potential buyers as they go through the sales funnel. It involves understanding leads’ needs, responding to them, and guiding them towards making a purchase decision.

Nurturing isn’t about immediate sales; it’s about building trust and establishing credibility over time. It’s about warming up prospects to the idea of buying from you, often slowly.

Lead Scoring

Think of lead scoring as a way to measure the value of your prospects. Some prospects are worth a lot; they may represent big potential deals that are likely to close. Other prospects are unlikely to buy from you or may represent small deals. As leads, they have less value.

Lead scoring helps different teams prioritize and respond to leads. For example, highly valuable leads may warrant an account executive’s immediate and focused attention. Low-value leads may only warrant automated follow-up sequences that don’t involve a human operator.

Marketing Qualified Lead (MQL)

A marketing qualified lead (MQL) has engaged with your company in some way but has not given you their business yet. For example, they may have downloaded a white paper, attended a webinar, or visited your website before.

An MQL is assumed to be in the consideration stage of their purchase. They are evaluating different options but have not picked one yet. As a result, they’re more likely to become a paying customer than someone who has never encountered your business before.

Master Service Agreement (MSA)

A master service agreement (MSA) is a comprehensive contract. It outlines the general terms and conditions related to successive or future contracts, projects, or transactions. These agreements can include:

- Payment terms

- Delivery deadlines

- Intellectual property rights

- Confidentiality clauses

- Dispute resolution processes

What’s written in an MSA can affect costs, deliverables, security, and more. This makes MSAs cornerstones of successful business relationships, both short-term and long-term.

Middle of the Funnel (MOFU)

The middle of the funnel (MOFU) is the intermediary stage in the B2B sales funnel. It sits between the top of the funnel (TOFU) and the bottom of the funnel (BOFU).

In the MPFU, potential clients have already recognized their need to actively explore solutions. They're engaging, comparing, and looking for an offer that makes sense for them.

Monthly Recurring Revenue (MRR)

Monthly recurring revenue (MRR) is the revenue a business expects each month. This metric is especially useful for software-as-a-service (SaaS) platforms, recurring membership programs, and subscription services.

MRR offers a clear overview of incoming revenue. Thus, it’s a good indicator of a company's financial health and future growth.

Net Promoter Score (NPS)

Net promoter score (NPS) is a metric that gauges customer satisfaction and the likelihood of a client recommending a product or service.

NPS operates on a scale of 0-10. A typical NPS question would be, "On a scale of 0-10, how likely are you to recommend our product/service?"

These responses are categorized into three segments:

- Promoters (9-10)

- Passives (7-8)

- Detractors (0-6)

The NPS is calculated by subtracting the percentage of detractors from the percentage of promoters.

Opportunity Management

Opportunity management tracks and manages sales opportunities as they progress through the sales funnel.

It involves identifying potential leads, evaluating their worth, and determining the best strategies to reach them. It also includes monitoring a lead’s progression from entering the funnel until they make a purchase.

Outbound Sales

Outbound sales is when sales professionals reach out and initiate conversations with prospects. Tactics include cold calling, emailing, and sending LinkedIn messages. An outbound sale starts when a salesperson contacts a prospect, cold or warm, to initiate contact.

Pain Point

In sales and marketing, pain points are things bothering individuals and organizations. These can manifest as unmet needs, negative emotions, or anything else prospects struggle with.

Understanding pain points helps you tailor your offer, marketing messages, and sales efforts better. By positioning your product as what the target audience needs, you can drive more revenue more easily.

Point of Contact (POC)

The point of contact (POC) is your main communication link with a prospective client. Cultivate strong relationships with POCs, but also try to expand your connections within the organization. This can protect your deal if your POC leaves; it provides additional advocacy for your solution.

Qualified Lead

A qualified lead is a prospect who has shown a certain level of interest in your offer. They are often labeled as such in CRM software. Each kind of qualified lead matches specific criteria set by a business.

For example, an information-qualified lead could be anyone who’s a prospective customer. A marketing-qualified lead may be someone who’s signed up to receive information on an ongoing basis.

Leads that align with these set prerequisites are more likely to convert at each stage of the sales funnel. Leads with particularly high scores may align with your ideal customer profile.

Sales Commission

A sales commission is a monetary reward a sales representative earns upon finalizing a sale. Typically calculated as a percentage of the total sale price, it can also be a preset amount. Its goal is to motivate salespeople to close deals and consistently hit or surpass sales targets.

At their core, commissions reward a salesperson's skill and success. With every sale made they earn more, tying their hard work to tangible rewards.

Sales Demos

Sales demos are real-time showcases of a product or service. When used correctly, they help close deals with customers considering your product.

Good sales demos combine storytelling, education, and persuasive selling to demonstrate value. Ideally, a sales demo is highly targeted to the audience’s specific needs. The better it addresses real needs and pain points, the likelier it is to help close sales.

Sales Development Representative (SDR)

A sales development rep (SDR) handles the early stages of the sales process. Their main job isn't to close deals; it's to qualify leads.

An SDR often works together with marketing channel owners. They may directly use sales tools and influence marketing strategy, too. Their role overlaps with, but is different from, a business development rep.

Sales Enablement

Sales enablement is designed to increase sales results and productivity. This is done by providing content, training, and coaching to sales teams and managers. The term refers to anything and everything that will help sales professionals close more deals faster.

Sales enablement focuses on the entire sales process and pipeline, from lead generation to discovery calls all the way through to conversion. It covers both sales-specific knowledge and product knowledge (i.e., what the product can do to produce value).

Sales Forecasting

Sales forecasting is the practice of estimating future sales over a specified period. These estimates are based on historical data, market trends, and other influencing factors.

Sales forecasting can be applied to products, services, or even entire business divisions. Estimates are also categorized by time — namely monthly, quarterly, or annually.

Sales Funnel

A sales funnel is a visual representation of the journey potential customers go through. It goes from the initial point of awareness about a product or service to the final stage of purchase or conversion.

The sales funnel is often depicted as an actual funnel or inverted pyramid. There’s a broad entry point at the top, representing prospects in the awareness stage. This narrows down to the bottom, representing the customers who decide to purchase.

Sales Intelligence

Sales intelligence is the collection and application of data that helps drive sales. This could include company profiles, buying behavior, and details on the industry landscape. It’s everything salespeople can use to make informed decisions while working.

To a lesser degree, sales intelligence can also refer to the tools, techniques, and best practices that drive data collection and usage.

Sales Pipeline

The sales pipeline is a visual tool for representing prospects' complete journey from awareness to purchase. While the actions prospects take at each stage vary by industry, the stages themselves apply everywhere.

Informally, pipeline refers to how much total business opportunity is available to you. For example, if you have potential deals worth up to $10 million in your pipeline, you have “$10m in pipeline” at the moment.

Sales pipeline is roughly equivalent to the sales funnel. A sales funnel is more often used in marketing; leads go top-to-bottom, vertically. A sales pipeline is more often used in sales; leads go left-to-right horizontally, or top-to-bottom vertically.

Sales Pitch

A sales pitch is a presentation that’s designed to persuade a prospect about the benefits and value of a product, service, or idea. The primary goal is to guide the listener towards making a favorable buying decision. A sales pitch can be delivered in person, over the phone, or via email.

Sales Quotas

Sales quotas are set targets that sales professionals are expected to achieve within a specified timeframe. Monthly and quarterly quotas are the norm in most industries. These targets can be based on revenue, the number of units sold, or other key performance indicators.

Service Level Agreement (SLA)

A service level agreement (SLA) is a formalized contract between a service provider and a client. This agreement explicitly details the quality, scope, and delivery timelines of the service offered.

With an SLA, both the provider and client have a clear understanding of responsibilities and deliverables.

The primary purpose of an SLA is to define the level of service a client can expect from a service provider. It acts as a safeguard for both parties, ensuring that the provider is held accountable for delivering as per the agreement, and the client understands their responsibilities and obligations in the partnership.

Social Selling

Social selling relies on social media platforms to find, connect with, understand, and nurture potential clients. It moves away from simply emailing or calling a prospect directly.

Primarily, though, social media is used to establish authority and credibility. It gives sales teams the opportunity to engage in meaningful conversations and provide personalized value.

Social selling can take place across multiple social media platforms. However, Facebook, LinkedIn, and Twitter/X are some of the most popular.

Top of the Funnel (TOFU)

The top-of-the-funnel (TOFU) is the initial stage in the buyer's journey. It's the point where potential customers become aware of a brand or a solution but have not yet decided to make a purchase.

The main goal at this stage is to attract as many potential leads as possible and educate them. To achieve this, marketers create content that answers questions, solves problems, and engages the audience. The goal is to inform without pushing a hard sell.

Upselling

Upselling is the practice of encouraging customers to buy a superior, more feature-rich version of a product. It can also take on the form of enhancements like additional features or complementary add-ons.

Skilled upselling it's not just about maximizing the sale; it's about understanding the customer's requirements. Effective upselling ensures that customers genuinely benefit from their upgraded purchase, creating added value with a brand or product.

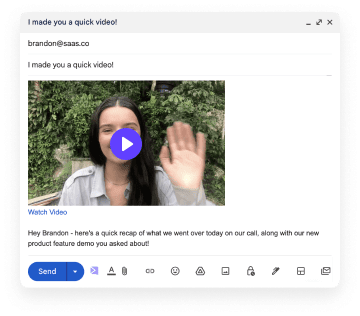

Video Messaging

Video messaging is the process of recording and sending asynchronous video messages. This can happen as a part of one-to-many marketing campaigns. It can also happen in the context of one-to-one sales or customer support exchanges.

Warm Email

A warm email is a prospecting email that's sent to someone with whom you have a connection. Personalize these emails based on your shared connection or recent interactions. Be clear about your purpose, but focus on how you can provide value to the recipient.

Learn the terms that matter to you, and grow your expertise

To use this guide to its full potential, start by focusing on the terms most relevant to your daily work. As you become more comfortable, you can explore other concepts. Over time, many of these terms will become part of your regular vocabulary.

Remember, being a great salesperson is about more than knowing industry terms. It's about understanding customer needs, solving problems, and building relationships. These terms are tools to help you do that more effectively.

Keep this guide as a reference. Use it when you need clarification on a concept or want to expand your knowledge. As you grow in your sales career, you'll naturally incorporate more of these terms into your work.